Content

Conversely, more conservative investors need not stick to fixed income, low growth assets. Buying blue chip stocks can offer the opportunity for capital gains that may, in many cases, outpace the rate of inflation which is a concern with fixed-income investments. And since many blue chip stocks pay dividends and rising dividends at that, investors have another avenue for collecting income from these high-quality stocks. Like the Dow Jones, many blue chip stocks have declined substantially in terms of their stock prices year to date. Apple’s gradual growth, paired with its increasing dividend payout, is an attractive combination. The stock’s dividend yield may be somewhat low, but the company’s dividend payout comprises less than 20% of Apple’s cash flows, meaning that continued dividend growth is likely.

Lockheed’s largest segment is Aeronautics, which is dominated by the massive F-35 program. Liquid Refreshment Beverages (LRB) category which makes up 60% of sales. Momentum in core brands such as Dr. Pepper and new launches are driving https://g-markets.net/helpful-articles/candlestick-patterns-to-master-forex-trading-price-2/ gains. The company is also growing by catering to the health-conscious consumer. Its fundamentals are robust, and management’s outlook is quite optimistic. At the same time, management forecasts adjusted diluted EPS growth of 6% to 7%.

The drinks and food on your shelf, the hair products in your bathroom, the credit card in your wallet, the shows you watch. Blue chip stocks are reliable, which is why they’re so appealing to investors. UnitedHealth Group is one of the largest private health insurers, providing medical benefits to 50 million members globally, including 5 million outside the U.S. at the end of 2021.

About MarketBeat

While we are independent, the offers that appear on this site are from companies from which finder.com receives compensation. We may receive compensation from our partners for placement of their products or services. We may also receive compensation if you click on certain links posted on our site. While compensation arrangements may affect the order, position or placement of product information, it doesn’t influence our assessment of those products. Please don’t interpret the order in which products appear on our Site as any endorsement or recommendation from us.

CSCO stock added 16.4% in the fourth quarter vs. the S&P 500’s gain of 10.7%. Indeed, components of the Dow Jones Industrial Average are heavily over-represented when it comes to hedge funds’ favorite stock picks. Fully 13 of the Dow’s 30 names rank among the stocks most widely held by hedge funds. We won’t know how hedge funds have adapted to current market turmoil until the next batch of regulatory filings come out in May, but we do know how they were positioned heading into 2022.

- In this manner, dividends can be compounded and used to enhance returns.

- Additionally, the company has not been shy about spending money, most-recently into more software products.

- Although the pros give this blue chip a consensus recommendation of Buy, conviction is highly mixed.

Lastly, we would be remiss not to mention that Apple stock has been the greatest creator of shareholder wealth in the world over the past 30 years. Among the arguments in favor of Johnson & Johnson are its diversification, although that’s about to change. The multifaceted firm is set to split off its consumer health business – the one that makes Tylenol, Listerine and Band Aid – from its pharmaceuticals and medical devices divisions. The breakup is meant to free the faster-growth, higher-margin parts of J&J from the drag of its more mature, less profitable operations.

Our Services

Apple made a similar change in 2021 with its Mac computer, replacing Intel processors with a more powerful Apple chip. CEO Tim Cook later said in an earnings call that the switch contributed to a 70% increase in Mac sales. Gains that come purely from stock price increases, on the other hand, can be elusive. Those gains aren’t definitively yours until you liquidate the position.

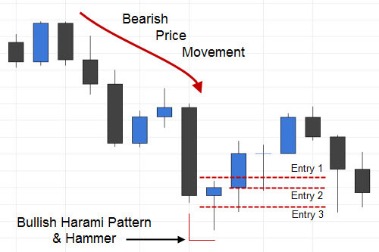

You can put together a watchlist of stocks on many stock news sites, including on MarketBeat. The purpose of the watchlist is to develop a list of the stocks you want to build positions in and then keep track of them, waiting for opportune entry points. Entry points are times when the stock’s price pulls back from higher levels, offering better value and yield for investors.

- With the global middle class growing rapidly, Nike is the elite brand in athletic footwear and apparel.

- In terms of returns, the S&P 500 index was up 15.9%, while the technology-heavy Nasdaq 100 index soared 36%.

- You can also buy a fund that tracks the S&P 500 or the Dow Jones Industrial Average since both include blue-chip stocks.

- Lockheed’s largest segment is Aeronautics, which is dominated by the massive F-35 program.

That’s when looking at their products and services, as well as where they do business. But going one step further, you can buy a basket of these companies for even more diversification. One thing these big names have in common is cost efficiency, which leads to a strong earnings growth and distribution. Advertising never stops, and they’re often a part of our daily lives. Dallas-based Texas Instruments generates over 95% of its revenue from semiconductors and the remainder from its well-known calculators.

The number of hedge funds counting PG as a top 10 holding jumped by more than half, to 32 in Q4 from 21 in Q3. But the Street remains mostly bullish on the blue-chip bank stock, giving it a consensus recommendation of Buy, with moderate conviction. Of the 26 analysts issuing opinions on BAC tracked by S&P Global Market Intelligence, 10 rate it at Strong Buy, six say Buy, eight have it at Hold and two call it a Strong Sell. Ultimately, hedge funds sold a net of 40.6 million shares in BAC in Q4.

Why are blue chip stocks popular among investors?

With China’s exports falling 0.3% in October in dollar terms year over year, global aggregate demand could be potentially weaker than expected. Another important point to note is that Freeport-McMoRan expects higher copper sales in 2022 and 2023. At a $5 per pound copper price, the company has guided for EBITDA of $17 billion. With a robust outlook for 2022, FCX stock is likely to remain in an uptrend.

Despite unfavorable macro conditions, the stock fell less than 2% in 2022, compared to the S&P 500, which dropped almost 20%. Volatility profiles based on trailing-three-year calculations of the standard deviation of service investment returns. Berkshire Hathaway (BRK.A 0.59%)(BRK.B 0.68%) is a major player in the insurance industry, offering various lines of commercial and personal insurance through subsidiaries GEICO and Gen Re. But Berkshire also owns a diverse set of businesses such as restaurant chain Dairy Queen, railroad giant BNSF, and its Berkshire Hathaway Energy utility company. With such a broad range of businesses, the company has a reputation for safety and security, as well as consistent performance. Finder.com is an independent comparison platform and

information service that aims to provide you with information to help you make better decisions.

Given the high inflation in the United States, the Federal Reserve has raised interest rates six times this year and many analysts think the central bank will raise the rate even further. 2022 has been a challenging year for many stocks in the market. Faisal Humayun is a senior research analyst with 12 years of industry experience in the field of credit research, equity research and financial modelling. Faisal has authored over 1,500 stock specific articles with focus on the technology, energy and commodities sector.

More on investing

Nike’s dividend yield is currently low compared to other companies, but it has a long history of annual payout increases. A broad definition of a blue chip stock is a well-known, high-quality company that’s considered a leader in its industry. The “blue chip” descriptor comes from the game of poker, in which blue chips have the highest dollar value.

I wrote in May that as long as Bud Light remains the official light beer of the National Football League, the company will eventually weather this storm. But in July, shareholders are likely to be telling the company it should have said less. After rocketing higher in 2021, aluminum prices have leveled off and are likely to stay that way through 2023.

At face value, a single share is worth more than 10% of a $10,000 account and may expose it to undue risk. Blue-chip stocks offer stability, safety and dividends through companies with well-entrenched businesses that have proven they can stand the test of time (and pay dividends while doing it). Blue-chip stocks also tend to be substantial businesses, large or mega caps, with deep moats related to their brands, product(s) or industries. They offer an element of safety and income for investors in the long haul. Among the many benefits is reduced volatility and, in many cases, market-beating dividend yields.

Its portfolio includes branded generic drugs, medical devices, nutrition and diagnostic products. Some of its best-known products include Similac infant formulas, Glucerna diabetes management products and i-Stat diagnostics devices. True, the company has been losing market share to competitors. But Intel’s central processing units (CPUs) are still found in 84% of desktop PCs and 78% of laptops. INTC furthermore commands roughly 90% of the market for servers, which are in high demand amid the shift to cloud-based computing.

Moreover, the number of hedge funds initiating stakes rose by more than half, to 61 from 40 in the previous three-month period. You can buy blue chip stocks as individual stocks or through funds that contain tens or hundreds of stocks. Investing in individual shares of blue chip stocks comes with greater risk than investing in diversified mutual funds and exchange-traded funds (ETFs). Stable and reliable, having a blue chip stock in your portfolio is never a bad thing. This stability points to strong financial footing, meaning no debt and a lot of efficiency. Blue chip stocks are often protected from severe volatility, making the risks quite limited.

Management forecasts indicate that Adenza will accelerate the solutions business — capital access platforms and financial technology — growth rate to 8-11% from 7-10%. Nasdaq has a history of executing acquisitions and integrating them successfully. Amid the carnage in these blue-chip stocks at lows, there are terrific opportunities for investors. Remember, these established large-cap companies have been through crises and emerged stronger. In terms of returns, the S&P 500 index was up 15.9%, while the technology-heavy Nasdaq 100 index soared 36%.

A five year beta of 0.39 sums up the company’s steady attributes. The stock is currently trading close to its all-time high, despite seeing only a small rise year-to-date. In the company’s April 2023 Q1 results, PG revealed that, although it has seen rising input costs, it nonetheless boosted profit margins for the first time in more than two years. The company raised prices by close to 10%, which helped generate a 4.1% increase to net sales—all despite sales volume falling 3%. Apple (AAPL 1.03%) is one of the most profitable companies in the world, and it has pioneered advancements in the technology sector throughout its history.